Some food items might be subjected to an extra Malaysian Custom Excise import duty such as a 15 tax on. Approval Process of Value-Added Activity and The Expansion Scope of Additional Activities.

Floor Mats Heavy Duty Rubber Liner Set For Chevrolet Cruze Hatchback 2011 2019

Currently the importation of bicycles other than racing bicycles and bicycles designed to be ridden by children falling under the HS tariff code 87120030 00 are subject to import duty at the rate of 25.

. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Malaysia Vegetable Imports by country in US Thousand 2019 In 2019 the top partner countries from which Malaysia Imports Vegetable include Indonesia China United States Argentina and. Malaysia imports for 2019 was 21089B a 496 decline from 2018.

Merchandise trade statistics Malaysia MYS exports and imports with partner countries including number of products Partner share Share in total products MFN and Effectively Applied Tariffs duty free imports dutiable imports and free lines and number of trade agreements for year 2019. Trying to get tariff data. The maximum amount of stamp duty on foreign currency loan agreements be increased from rm500.

Effective from 1 January 2019 import duty rate is proposed to reduce from 25 to 15 on such bicycles. Export Procedures on The Import DutyTax Exempted Raw Materials and Packaging Materials. Currently the importation of bicycles other than racing bicycles and bicycles designed to be ridden by children falling under the HS tariff code 87120030 00 are subject to import duty at the rate of 25.

In April 2019 India raised the import duty on wheat to 40 from 30 as domestic prices had dropped to discourage cheaper wheat imports. Malaysia imports for 2021 was 23044B a 2434 increase from 2020. However some goods are taxed at the reduced rate of 5 while others are completely exempt from sales tax.

Merchandise trade and tariff statistics data for Malaysia MYS imports from partner countries including trade value number of products Partner share Share in total products MFN and Effectively Applied Tariffs duty free imports dutiable imports and free lines and number of trade agreements for year 2019. Written by Prasanta Sahu Sandip Das August 5 2022 33000 am. Stamp duty calculation malaysia 2019.

Effective from 1 January 2019 import duty rate is proposed to reduce from 25 to 15 on such bicycles. Duties for those boxes which are specially shaped or fitted for the conveyance or packing of semiconductor wafers masks or reticles HS 3923109010 have been reduced from 20 to 15. Borang Kastam No7 K7 Malaysian Tourism Tax System MyTTX ATA Carnet.

On 24 December 2018 the Malaysian government partially reduced the import duty for boxes cases crates for packing of goods HS 392310. Enter the security code and proceed to as an example i want to check duty for garnet abrasive product from the uae so i will type as per below and search. Rules Of Origin ROO Temporary Import.

Goods imported into Malaysia are subjected to Sales Service Tax SST of 10 and these goods can be anything from food items to electronics. For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent extremely high effective tariff rates. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia.

Other types of boxes HS. Once you click on above link you will see below screen. Merchandise trade and tariff data for Malaysia MYS Textiles and Clothing import from all countries trading partner including Trade Value Product Share MFN and Effectively applied tariffs count of duty free and dutiable products for 2019.

If the full value of your items is over 500 MYR the import tax on a shipment will be 10. Electronic Pre-Alert Manifest ePAM Pre-Arrival Processing PAP INDIVIDUALS. For example if the declared value of your items is 500 MYR in order for the recipient to receive a package an additional amount of 5000 MYR in taxes will be required to be paid to the destination countries government.

PROCEDURE GUIDELINES Currently selected. Morphine heroine candu marijuana etc are strictly prohibited. The following goods are absolutely prohibited from exportation.

Import and export of illicit drugs eg. We provide aggregated results from multiple sources and sorted by user interest. Malaysia imports for 2018 was 22190B a 1013 increase from 2017.

Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods. Malaysia imports for 2020 was 18532B a 1212 decline from 2019.

Special Offers Shimano Stella 4000 Sw B Xg Heavy Duty Saltwater Reel In Stock Free Shipping You Can Save More Money C Saltwater Reels Shimano Saltwater

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

China Clarifies Duty Exemption Policy For Foreign Investment In Encouraged Industries

What Is The Difference Between Taxes Duties And Tariffs Trg

![]()

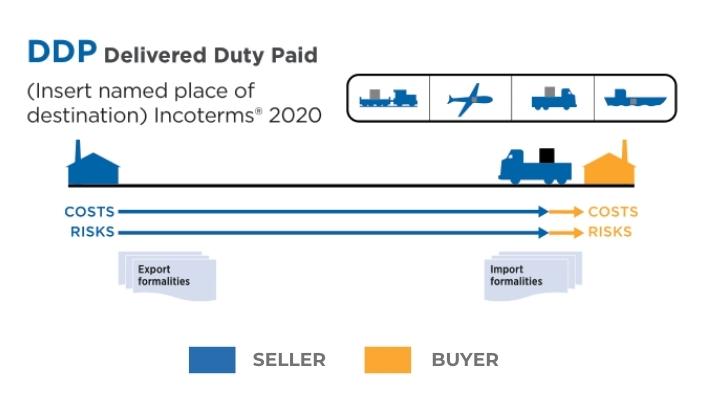

The Ultimate Guide To Import Custom Duty Icontainers

Customs Duty De Minimis Important Info For International Shipping Fulfillrite

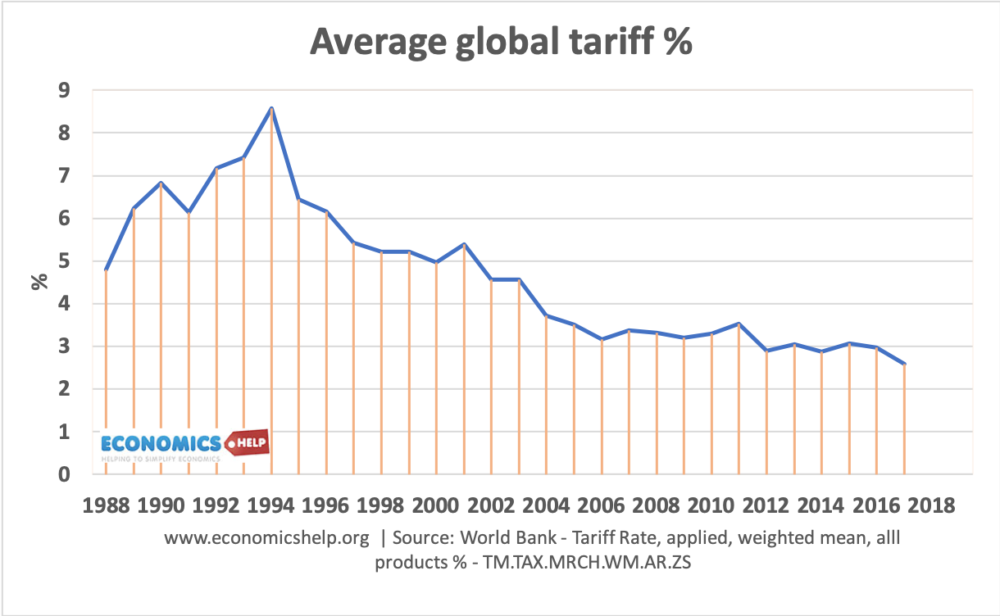

Examples And Types Of Protectionism Economics Help

How Duties And Taxes Are Calculated Youtube

How Are Import Duties And Taxes Calculated

Tire Imports Spike Despite Elevated Duties Tire Business

Budget2019 Amalgamation Of Cgtmse Cgfmu Will Remove Complexities Of Msme Loans Says Sbi Report Budgeting Lenders Loan

![]()

The Ultimate Guide To Import Custom Duty Icontainers

Regulation On Imposing Anti Dumping Duty Under Vietnam Laws Wooden Cubes Wooden Light Wooden Floor

Customs Duty Tax Receipts Uk 2022 Statista

Animaniacs Mcdonalds Happy Meal Toy Yakko Ridin Ralph 1993